Since 2010, sales of portable batteries have remained roughly stable at an average of 450 g per inhabitant, but with the mass distribution of the now inexpensive Li-ion batteries, their share of portable and industrial batteries has risen rapidly. While the proportion of lithium batteries hardly changed until the 2010s, the Li-ion battery system now dominates the sales figures. Enormous tonnages of this type are also sold in industry segments such as e-bikes, scooters etc.. In future, they will also be subject to the new legal definition of industrial batteries (> 5 kg) and will also have to meet their own collection targets.

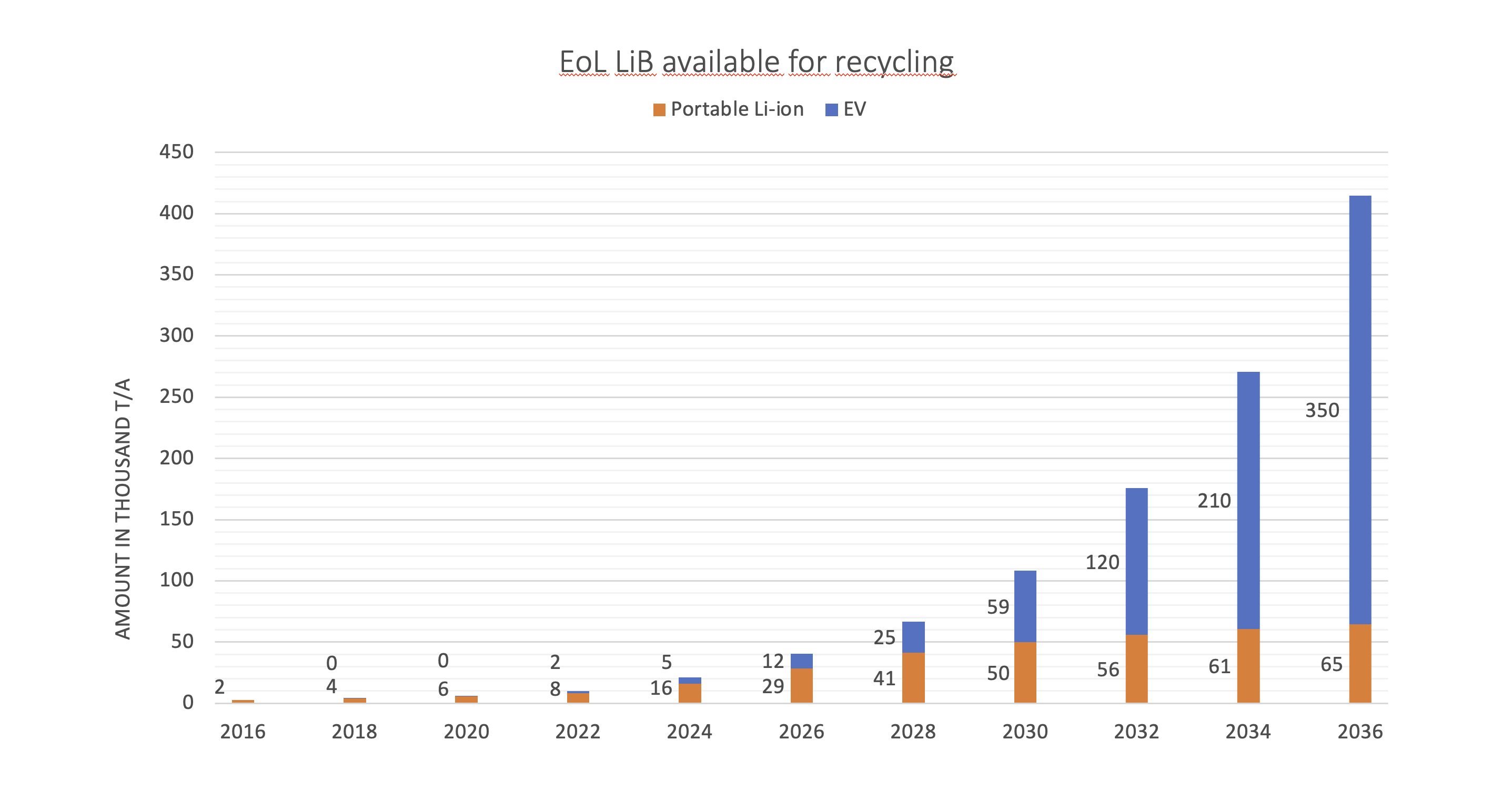

However, the successful adaptation of lithium-ion batteries in electromobility and stationary electricity storage has now opened a new chapter in battery distribution. Regardless of which possible scenario of transportation transformation will drive electromobility – the demand and sale of batttery storage volumes will increase exponentially.

Accurec has been updating its market analyses for the sale and fate of Li-ion batteries every year for over 10 years.

In doing so, we take into account important influencing factors that should better describe the expected waste flow of Li-ion batteries. Among other things, we analyze

– the re-export (non-European sale of devices with imported batteries)

– the lifetime of batteries and devices depending on their application

– consumer behavior with regard to discarded batteries and devices (hoarding effect)

– efficiency of portable battery collection systems in all European countries

– extraction efficiency of embedded batteries in electrical appliances

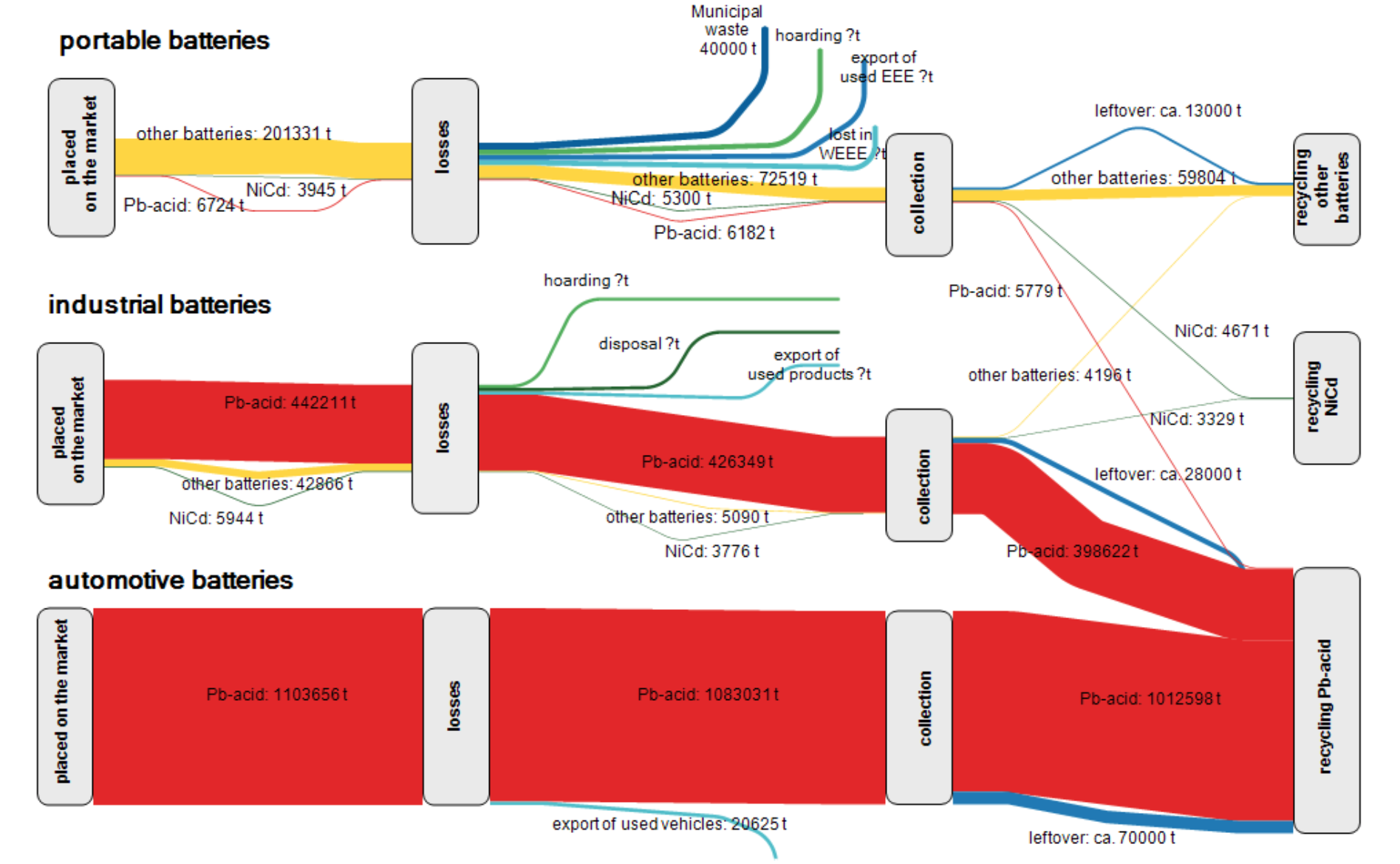

– estimation of the legal and illegal export of batteries (see Figure 2)

In contrast, valid analyses of the use and disposal of electric vehicle batteries are still difficult to make due to a lack of long-term experience. On average, a service life of at least 10-12 years is assumed, with only a “second-use” share of less than 5% being assumed in the following forecast. This assumption is based on the experience of the long-term degression of Li-ion manufacturing costs, which can lead to a competitive advantage of new batteries in terms of price and performance compared to outdated second-use systems.

Forecasted waste stream of Li-ion batteries “Ready for Recycling” until 2036 by application