Seit 2010 ist der Gerätebatterieverkauf mit durchschnittlich 450 g pro Einwohner etwa stabil, jedoch stieg mit der Massenverbreitung des mittlerweile kostengünstigen Li-Ion Akkus ihr Anteil bei Geräte- und Industriebatterien rasant an. Während bis zu den 2010er Jahren der Anteil an Lithiumbatterien sich kaum verändert hat, übermnimmt nunmehr das Li-Ion Batteriesystem die Dominanz in den Verkaufszahlen. Enorme Tonnagen dieses Typs werden auch in Branchensegmente wie E-bikes, Scooter etc. verkauft. Auch sie werden in Zukunft mit der neuen legalen Definition von Industriebatterien (> 5kg) extra erfasst und müssen auch eigene Sammelquoten erfüllen.

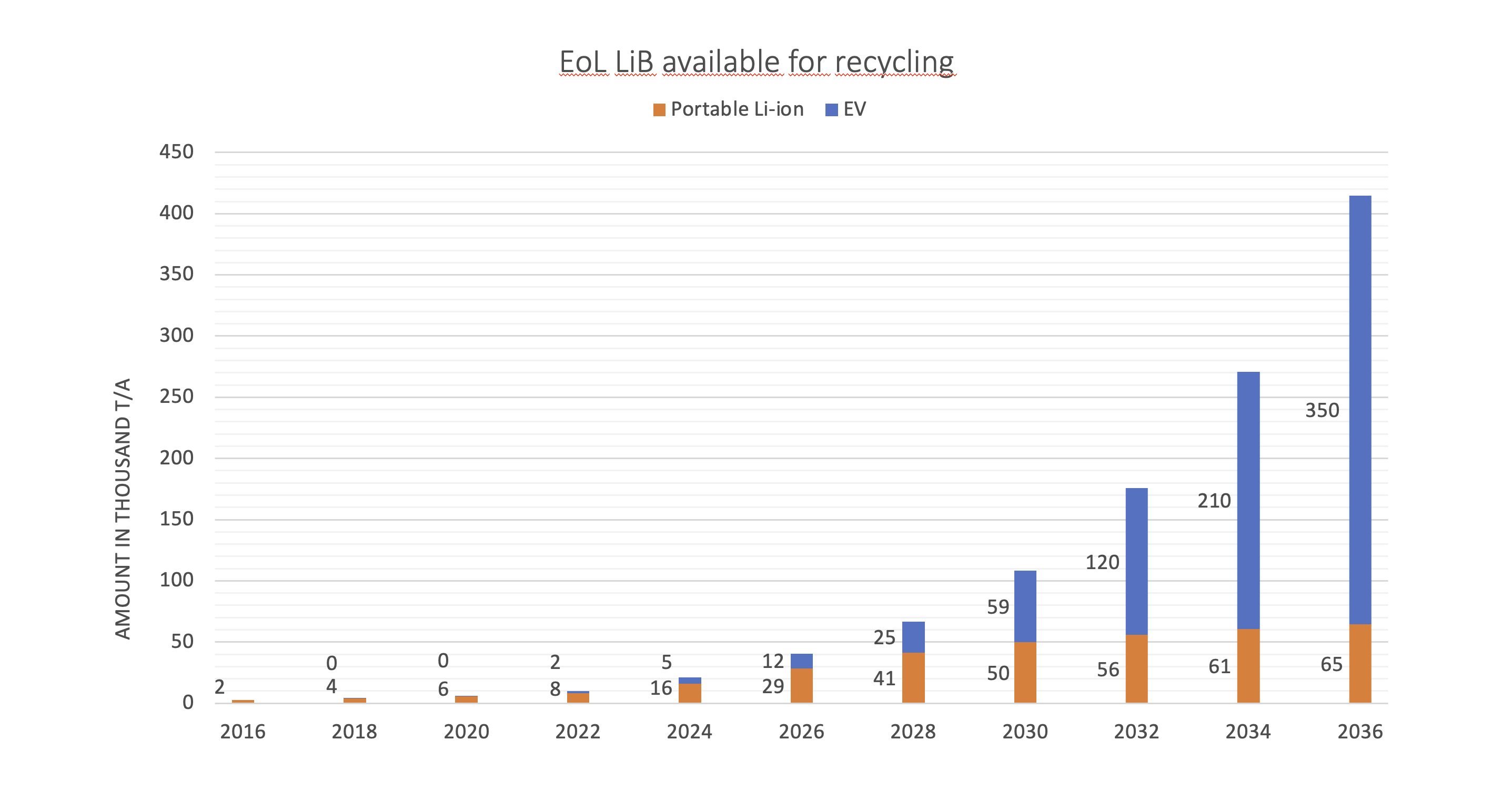

Die erfolgreiche Adaption des Lithium-Ion Akkus in der Elektromobilität und stationären Stromspeicherung hat nun aber ein neues Kapitel der Batterieverbreitung aufgeschlagen. Unabhängig welches mögliche Szenario der Verkehrstransformation die Elektromobilität treiben wird – der Bedarf und Verkauf von Stromspeichermengen wird exponentiell steigen.

Seit über 10 Jahren aktualisiert Accurec jährlich seine Marktanalysen für den Verkauf und den Verbleib von Li-Ion Batterien. Dabei berücksichtigen wir wichtige Einflussfaktoren, die den zu erwartenden Abfallstrom von Li-Ion Batterien besser beschreiben sollen. Unter anderem wird dazu untersucht:

– der Re-Export (außereuropäischer Verkauf von Geräten mit importierten Batterien)

– die Lebenswertung von Batterien und Geräten in Abhängigkeit ihrer Anwendungsgebiete

– das Verbraucherverhalten zu ausgedienten Batterien und Geräten (Hoarding Effekt)

– Effizienz von Gerätebatteriesammelsystemen in allen europäischen Ländern

– Extraktionseffizienz von eingebetteten Batterien in Elektrogeräten

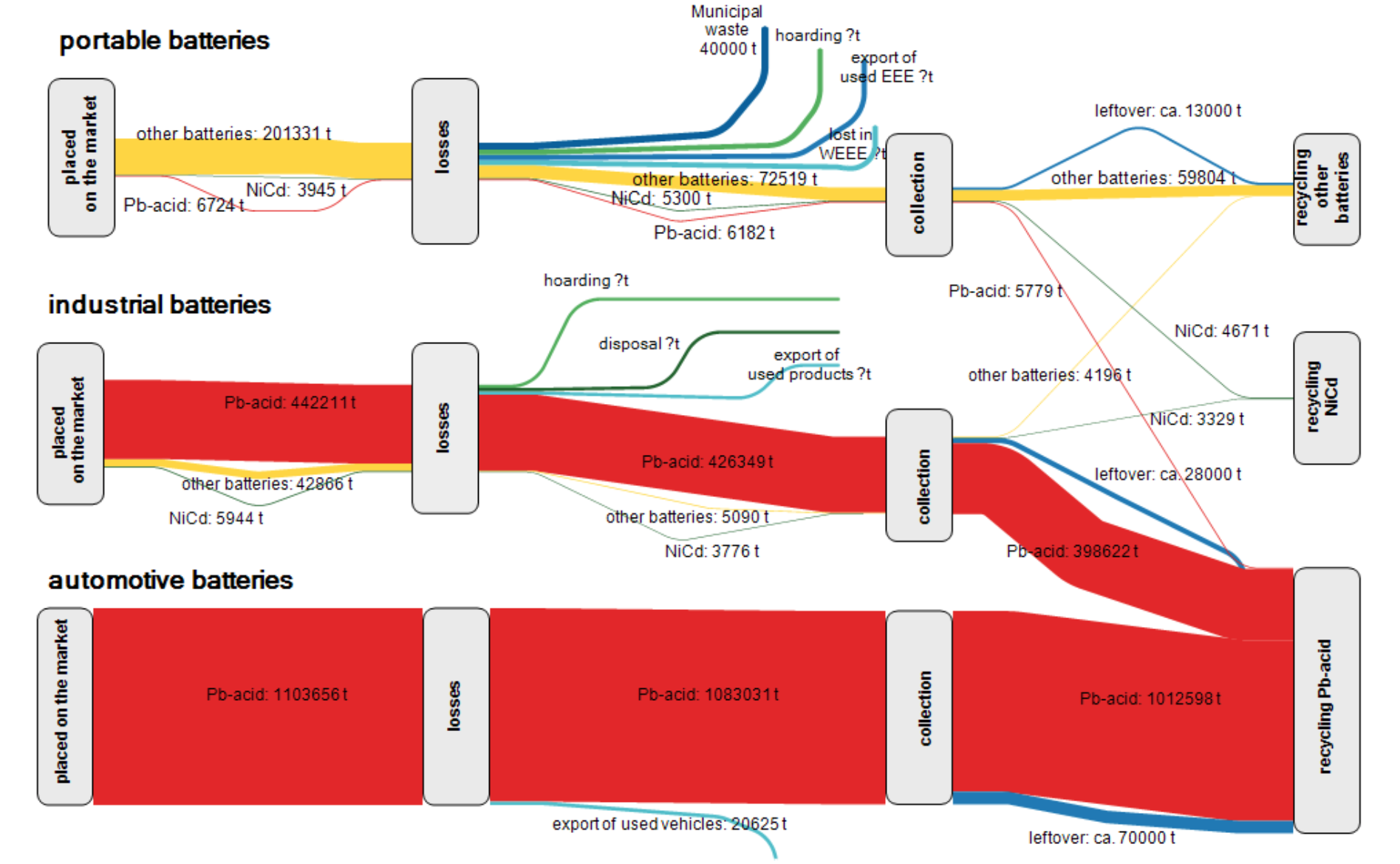

– Abschätzung des legalen und illegalen Exports von Batterien (siehe Grafik 2)

Demgegenüber sind valide Analysen über die Nutzung und Entledigung von Elektrofahrzeugbatterien aufgrund fehlender langjähriger Erfahrungen noch schwerlich möglich. Durchschnittlich geht man von einer Lebensdauer von mindestens 10-12 Jahren aus, wobei in der nachfolgenden Prognose lediglich ein „Second-Use“-Anteil weniger als 5% angenommen wurde. Diese Annahme beruht auf der Erfahrung der langjährigen Degression von Li-Ion Herstellungskosten, die zu einem Wettbewerbsvorteil von Neubatterien in Preis und Performance gegenüber veralteten Second-Use Systemen führen kann.

Prognostizierter Abfallstrom Li-Ion Batterien „Ready for Recycling“ bis 2036 nach Anwendungen